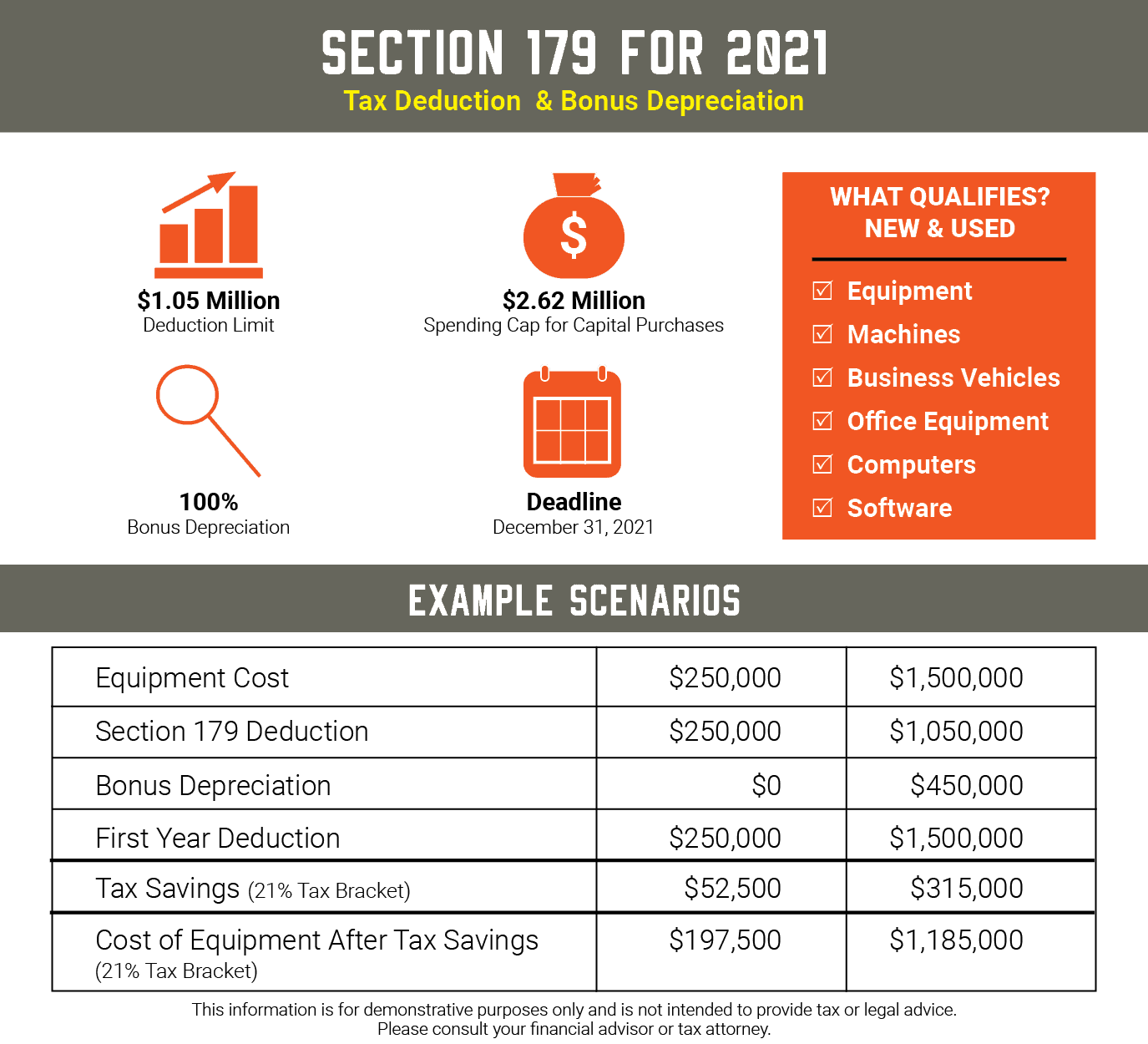

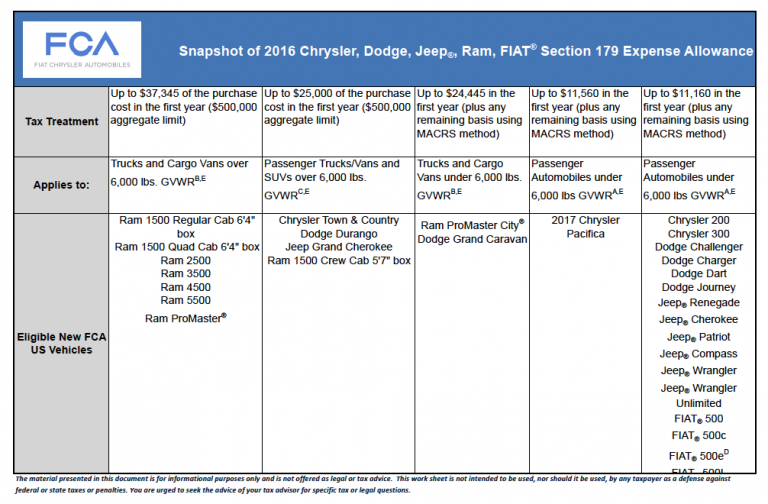

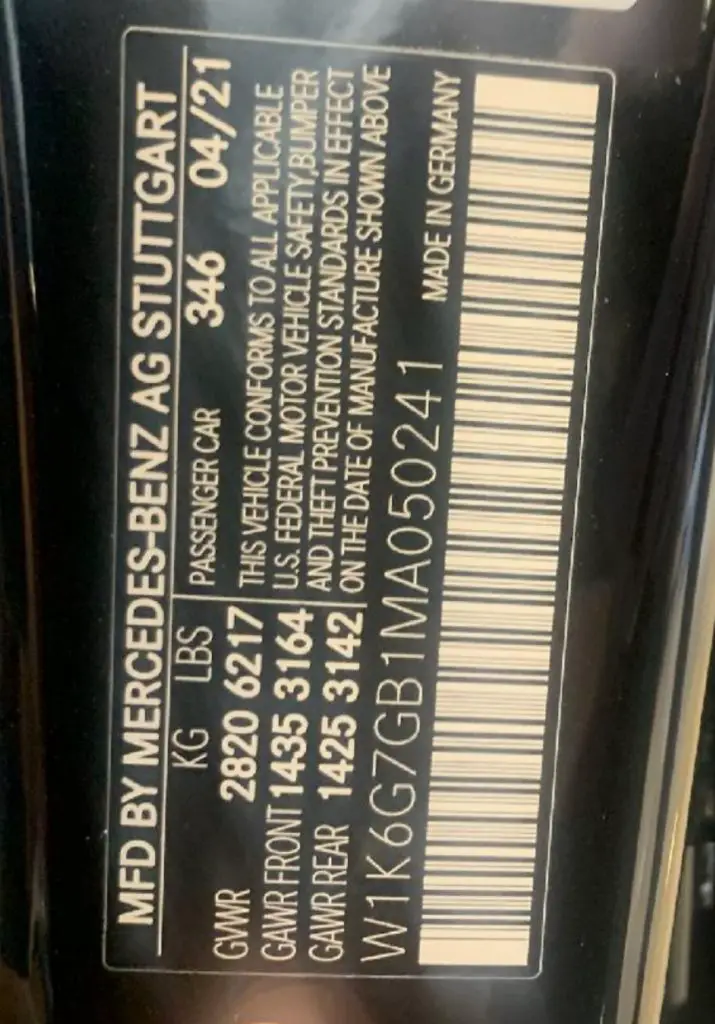

Section 179 Deduction Vehicle List 2025 In. Remember to verify the exact gvwr of the vehicle model and trim level to ensure qualification. Section 179 is a tax deduction that allows businesses to deduct the full purchase price of qualifying equipment and vehicles in the year they are placed into service.

However, there are other factors to consider when choosing a vehicle beyond weight. For vehicles under 6,000 pounds in the tax year 2025, section 179 allows for a.

[Update] Section 179 Deduction Vehicle List 2025 XOA TAX, In this comprehensive guide, we’ll explore the section 179 deduction, explore the list of eligible vehicles for 2025, and provide you with practical insights to navigate the process seamlessly.

Section 179 Deduction Vehicle List 2025 Excel nedi vivienne, In this comprehensive guide, we’ll explore the section 179 deduction, explore the list of eligible vehicles for 2025, and provide you with practical insights to navigate the process seamlessly.

![[Update] Section 179 Deduction Vehicle List 2025 XOA TAX](https://www.xoatax.com/wp-content/uploads/Section-179-1024x576.webp)

What Vehicles Qualify For Section 179 2025 Agna Merrill, For vehicles under 6,000 pounds in the tax year 2025, section 179 allows for a.

Section 179 Deduction 2025 Vehicle List Chris Antonina, The section 179 vehicle list for 2025 features a diverse range of options, from.

What Vehicles Qualify For Section 179 2025 Schedule Ula Lianna, However, there are other factors to consider when choosing a vehicle beyond weight.

Section 179 Deduction Vehicle List 20232024, If you use a car or truck for business purposes, you may be eligible for a section.

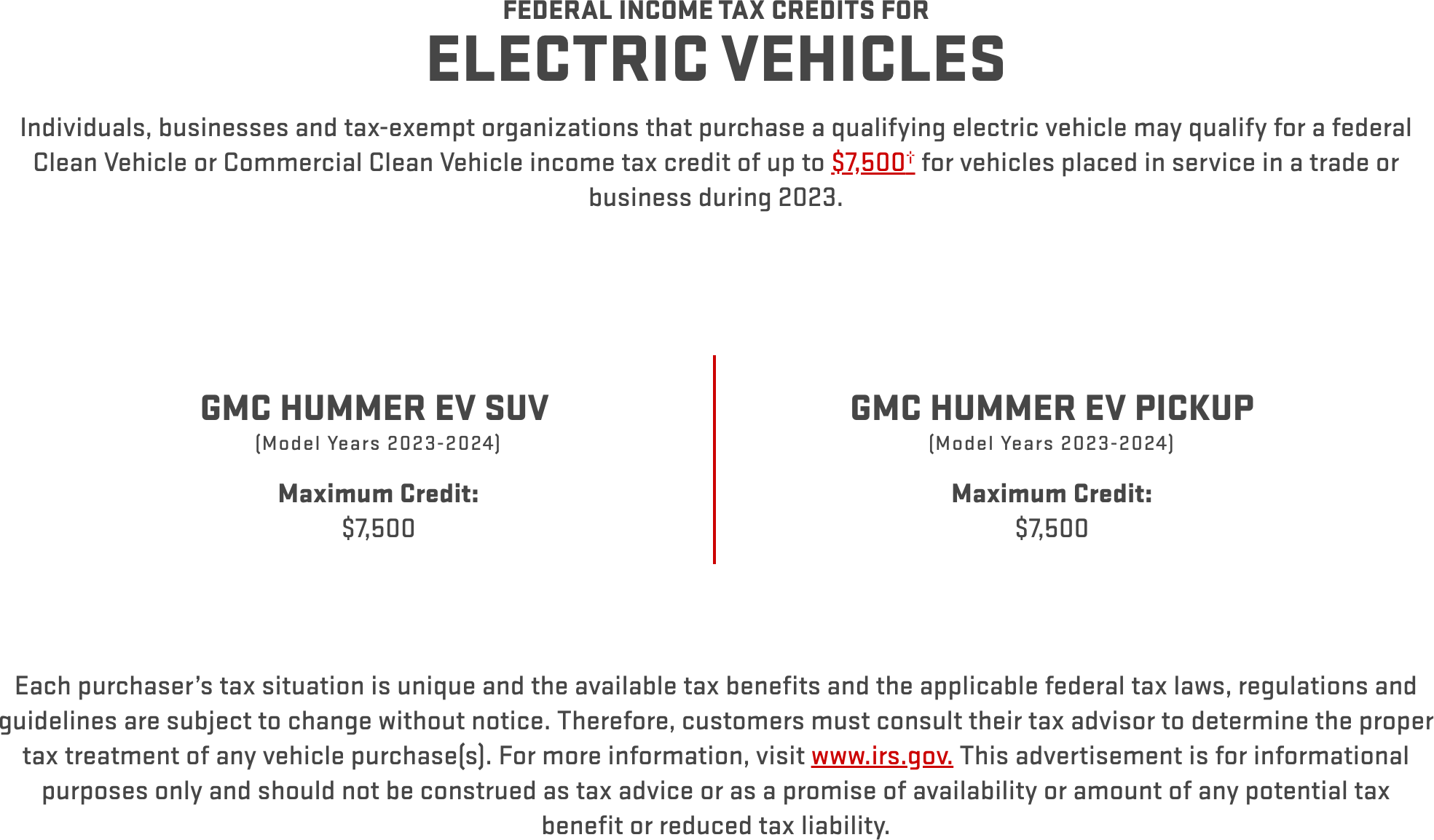

Section 179 For Vehicles 2025 etti nollie, In 2025 (taxes filed in 2025), the section 179 deduction is $1,220,000.

Section 179 Deduction Limit for 2025 and 2025, However, there are other factors to consider when choosing a vehicle beyond weight.

Section 179 Deduction 2025 Vehicle List Chris Antonina, It’s a question many small businesses ask.