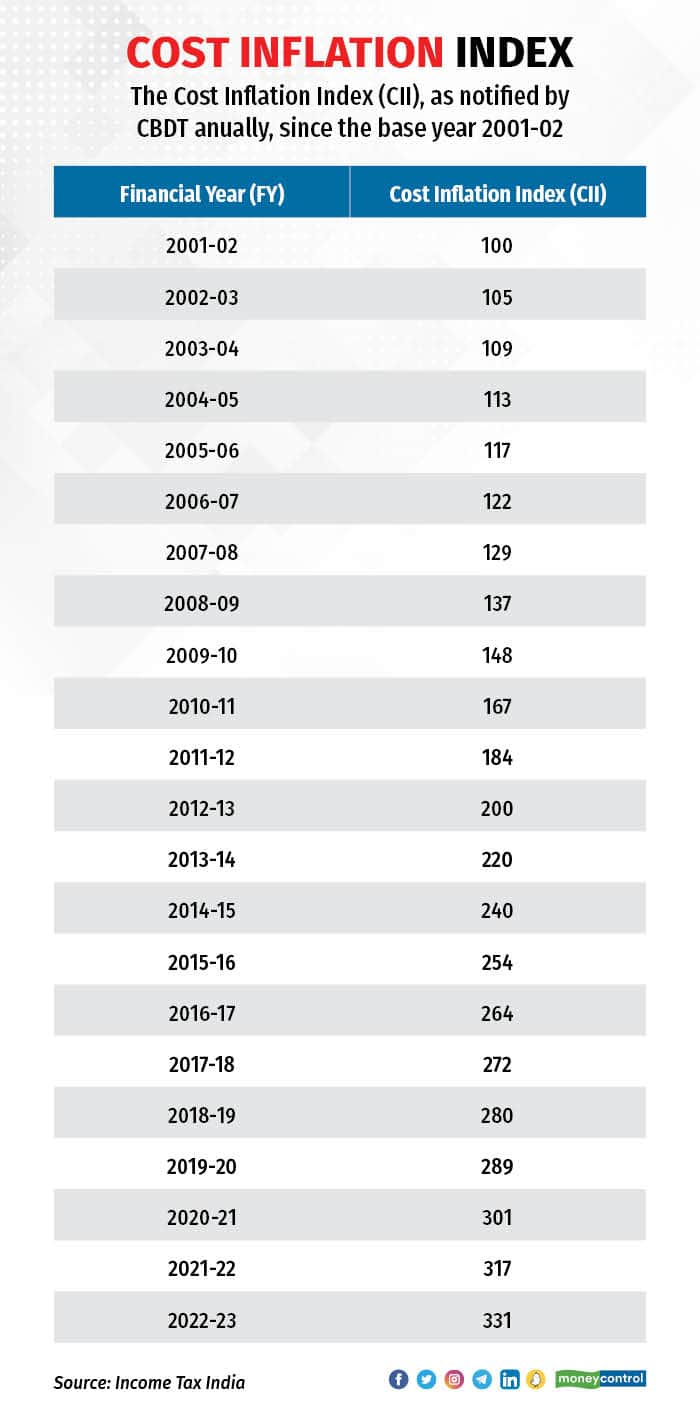

Capital Gains Increase 2025. What is cost inflation index? (investments held for a year.

According to the federal budget, the inclusion rate — the portion of capital gains on which tax is paid — for individuals with more than $250,000 in capital gains in a. While perth saw the greatest increase to property values last month, sydney remains the only capital city with a median property value over $1 million, according to.

While it estimates it will bring in $19.4 billion in revenue from this tax increase over the next five years, $6.9 billion of that is projected to be generated in 2025,.

5 Hacks To Avoid Capital Gains Tax In Real Estate, The budget proposes to increase the capital gains inclusion rate from 50 percent to 66.67 percent for corporations and trusts, and from 50 percent to 66.67 percent on the portion. The capital gains tax rate that applies to profits from the sale of stocks, mutual funds or other capital assets held for more than one year (i.e., for long.

Capital Gains vs. Ordinary The Differences + 3 Tax Planning, So for the first $250,000 in capital gains, an individual. The tax rates remain the same for the sale of investments.

(PDF) Inflation and Capital Gains, Capital gains tax rates for 2025 the irs may adjust the capital gains tax rate each year. Newly announced inflation adjustments from the irs will tweak the rules on capital gains taxes in 2025.

Capital Gains Distribution What It Is, How It’s Taxed., And it is this unintended consequence of a prominent part of the 2025 federal budget that worries me the most. So for the first $250,000 in capital gains, an individual.

Cost inflation 1606_002, Last updated 6 march 2025. President biden’s $7.3 trillion fy 2025 budget released last month, proposes several tax changes aimed at wealthier taxpayers,.

The Difference Between Capital gains and Investment Avisar CPA, The budget proposes to increase the capital gains inclusion rate from 50 percent to 66.67 percent for corporations and trusts, and from 50 percent to 66.67 percent on the portion. So for the first $250,000 in capital gains, an individual.

capital gains distribution, We've got all the 2025 and 2025 capital gains tax. So for the first $250,000 in capital gains, an individual.

2025 Long Term Capital Gain Rates Ciel Melina, 4 min read 31 jan 2025, 11:47 am ist. And it is this unintended consequence of a prominent part of the 2025 federal budget that worries me the most.

Capital Gains Harvesting In A Personal Taxable Account — Physician, Your 2025 capital gains bill will depend on 4 main things. While perth saw the greatest increase to property values last month, sydney remains the only capital city with a median property value over $1 million, according to.

How Do I Avoid Capital Gains Tax When Selling a House?, The rates apply to assets sold for a profit in 2025, which are reported on tax returns filed in 2025. (investments held for a year.

On april 16, 2025, the deputy prime minister and minister of finance, chrystia freeland, presented the government’s budget.