457 B Maximum Contribution 2025. The maximum amount you are allowed to contribute to your 457(b) plan is based on your taxable compensation as defined by the internal revenue code. As of 2025, the irs has set the annual contribution limit for 457 (b) plans at $20,500.

Get any financial question answered. 457(b) contribution limits will increase from $22,500 to $23,000 in 2025.

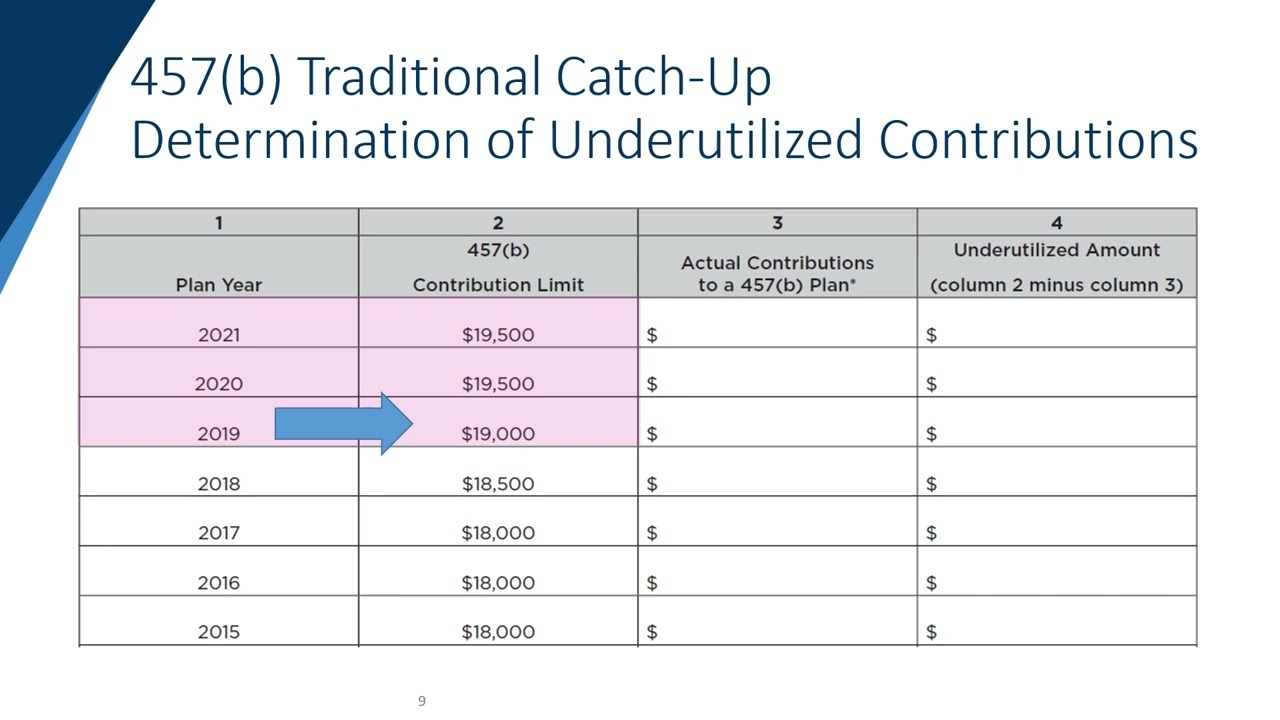

How to Fill out the 457(b) Traditional CatchUp Form YouTube, The irs has announced the 2025 contribution limits for retirement savings accounts, including. Review the irs limits for 2025.

Significant HSA Contribution Limit Increase for 2025, Section 457 retirement plan contribution limits. 457(b) contribution limits will increase from $22,500 to $23,000 in 2025.

457 Calculator (2025), The maximum amount you are allowed to contribute to your 457(b) plan is based on your taxable compensation as defined by the internal revenue code. The contribution limits for 401 (k), 403 (b) and eligible 457 plan elective deferrals and for designated roth contributions are projected to rise to $23,000 in 2025.

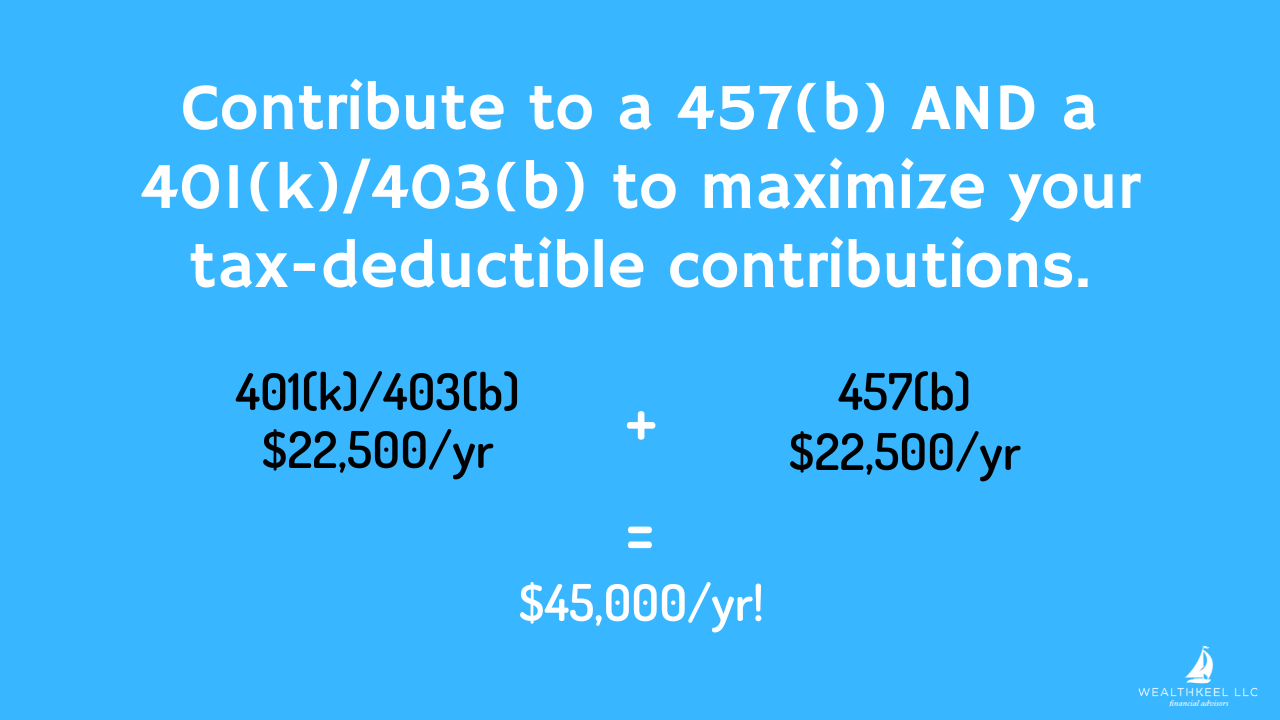

What is a 457(b) Plan & How Does it Work? WealthKeel, For 2025, the basic contribution limit is $23,000. In 2025, people under age.

401l Contribution Limits 2025 Carry Crystal, Per irs guidelines, in 2025 you may contribute. Find out how much individuals.

457(b) Plans Administration of Special Catch up Contributions YouTube, In 2025, eligible employees who elect to make deferrals to both a 403 (b) and 457 (b) plan will generally be able to contribute up to $23,000 in deferrals to their. Find out how much individuals.

457 Calculator (2025), That’s an increase of $500 over 2025. Get any financial question answered.

Understanding 457 Plans Scarlet Oak Financial Services, Look for tax deductions for specific jobs. Review the irs limits for 2025.

2025 403b Limit Jane Roanna, The maximum amount you can contribute to a 457 retirement plan in 2025 is $23,000, including any employer contributions. How 457 (b) plan works who is eligible to enroll in a 457 (b) plan?.

403(b) vs 457(b) Eligibility, Process & Contribution Comparison, The irs has announced the 2025 contribution limits for retirement savings accounts, including. The contribution limit for traditional and roth iras increased to $7,000.

_vs._457(b).png?width=960&height=540&name=403(b)_vs._457(b).png)

Most of the dollar limits, including the elective deferral contribution limit for 401 (k), 403 (b) and 457 (b) plans, the annual compensation limit under 401 (a) (17) and the maximum.